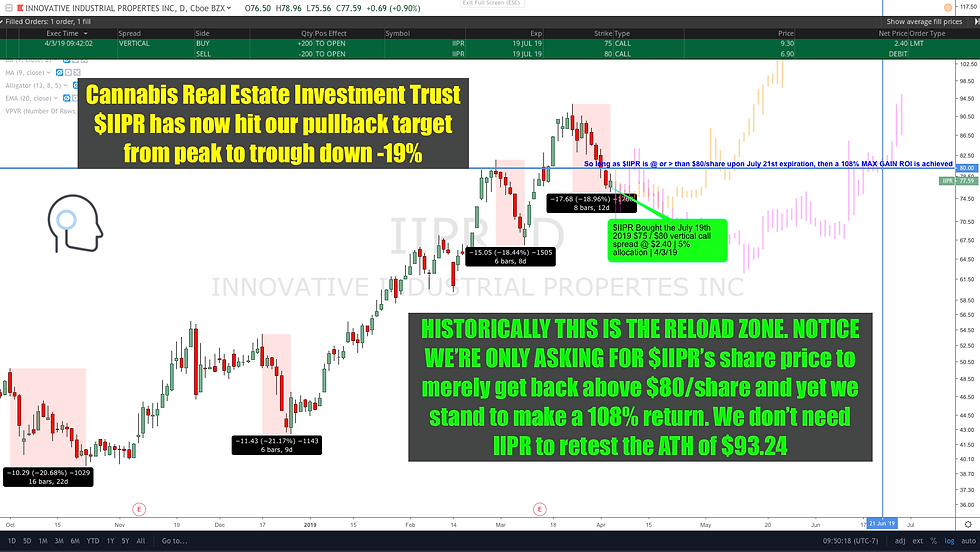

$IIPR Cannabis REIT - Heading Higher off this Pullback - Position Taken

- Momentum Stock Alerts

- Apr 3, 2019

- 1 min read

BotTrigger Trade Alert: $IIPR bought the July 19th $75 / $80 Vertical Call Spread @ $2.40 for a 5% allocation. MAX GAIN = $5 for a 108% return so long as IIPR's share price merely closes @ or greater than $80/share upon expiration.

We have been waiting for IIPR to meaningfully pullback so that we option premiums would get significantly discounted. We now have that with this -19% pullback that has occurred from the ATH peak of $93.24 to the trough low (thus far) of $75.56. Now what I love about this particular Call-Spread opportunity: we stand to make a 108% RETURN ON INVESTMENT so long as IIPR's share price merely closes @ or greater than $80/share UPON JULY 19th expiration which is just 107 days away. We're not asking/hoping for IIPR to even retest the highs in this setup. All the stock needs to do is move up about 3% from it's current level upon expiration this trade stands to make a 108% return. MAX VALUE = $5 which is what will yield that 108% return. Breakeven = IIPR's share price closing at least @ $77.50 upon expiration & MAX LOSS occurs is share price closes at or below $75 per share UPON EXPIRATION. Again we don't care if IIPR struggles a bit in the near to intermediate term...all we care about is price at least getting back above $80/share upon expiration and we're golden. Notice I've forecasted 2 different scenarios of how price action is likely to cultivate in getting there from now till then.

Comments