Multi-year Bull Market Continues. $AAPL $SPY $QQQ $AMZN $GOOG HEADING HIGHER

- Momentum Stock Alerts

- Jan 23, 2018

- 5 min read

Back in September of 2016 we want on record to publicly declare the following report on why the market was at the precipice for a MULTI-YEAR BULL RUN. We see no signs of that slowing down anytime soon → https://www.bottrigger.com/single-post/2016/09/21/SPY-Market-Outlook-Higher-High-Ahead

We had a breakout target on the $SPY for $240 & the $QQQ for $130. Today the $SPY trades above $280 and the $QQQ now around $170 just about 16 months since that publication. We've been making the case that although we'd have our fair share of pullbacks, that it was net-wise to be long this market. The thesis remains the same here.

It’s looking like another victory for low volatility. The 3-day government shutdown didn’t spook the market, 10-year yields above 2.6% haven’t spooked the market, and financial warfare against the dollar has yet to become a market moving variable. Volatility as measured by our $UVXY puts has taken a brief January pause in the $9 range, however, we expect the trend to continue to slide down further in the coming months.

As Washington resumes government funding ahead of a busy corporate earnings season, it appears the status quo is set to continue.

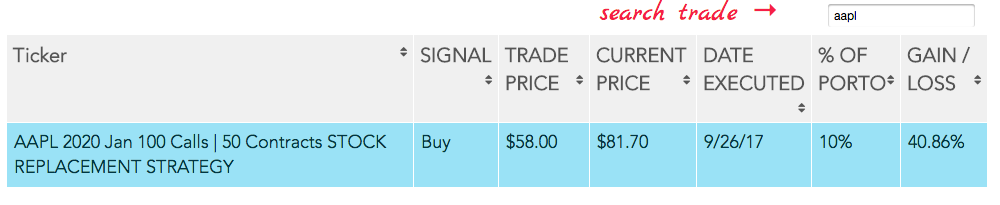

The combination of low volatility, tax reform, and Apple’s headline repatriation of foreign cash implies the Nasdaq $QQQ is a top investment vehicle for 2018. Alongside our Blockchain proxy vehicles, notably $OSTK $NVDA & $MGTI, all our $AAPL & $QQQ option trades are very handsomely in the green:

Perhaps the strongest of the bunch is Nvidia now up more than 75% since our first buy alert :

For those who have not yet taken a position on Nvidia, we will be issuing new buy alerts on this name once we get a meaningful pullback. For now, I would not chase buying call options up here. Wait for the next pullback period. If taking a new position here, consider nibbling a few long on the common stock in lieu of the options calls.

One that we've missed in it's remarkable bull run has been Netflix. We want some: Netflix’s better than expected earnings report only reinforces the theme. The company added 8.3 million subscribers beating its own guidance of 6.3 million. Full year 2017 revenue of $11.69 billion was up from $8.83 billion in 2016; 2017 net income rose to $558.9 million from $186.7 million. Original content to persuade cord-cutters continued to drive growth as Q4 debut’s of shows like Stranger Things 2, The Crown, Black Mirror, and Bright enabled subscriber growth even as Netflix raised prices for its standard service by $1 to $10.99 and the premium service increased $2 to $13.99. Average streaming hours per membership rose by 9% year over year. The report did have some negatives that caused one analyst from Buckingham Research Group to downgrade shares. Because of Kevin Spacey’s alleged misconduct, Netflix had to halt production of the sixth season of House of Cards. It also announced costs of $8 billion for content in 2018 which is an increased cash burn. Netflix will soon face fresh competition from Disney and Fox when the combined companies launch a new streaming service in 2019. As an individual investment, Netflix falls into a similar category as Tesla and Amazon. Many of these Nasdaq leaders are gaining market share but deal with high costs and uncertain profitability. Now we do own both $TSLA & $AMZN to the folio however we're looking for an opportunity to get out of our common stock positions and rotate into call options or some kind of call-spread that's positioned to milk more yield from their bullish trajectories. They continue to trend higher.

However, we won't be trading out of our common until we can get a meaningful pullback where we can do our rotation into an options trade when option premiums get hit. They're simply too expensive right now for an options rotation. For this reason, we’re comfortable with a diversified investment into $QQQ options rather than holding all eggs in one basket.

Hedge fund titan Ray Dalio added to the enthusiasm that was previously stated by David Tepper, ‘We are in this Goldilocks period right now. Inflation isn't a problem. Growth is good, everything is pretty good with a big jolt of stimulation coming from changes in tax laws..If you're holding cash, you're going to feel pretty stupid.’

Bulls remain in charge with no technical fear of risk. It is worth mentioning, Financial warfare between China and the United States is heating up. Not only is China reportedly launching petro-yuan contracts on in an effort to destabilize the dollar, but it is also in process of downgrading U.S. debt and banning cryptocurrency. In a phone call between President Trump and Xi, Trump ‘expressed disappointment that the trade deficit with China continued to grow’ during his first year in office and made it clear the ‘situation is not sustainable’. In response, China’s Dagong credit ratings agency downgraded U.S. debt from A- to BBB+ which now places our debt on par with that of Peru, Columbia, and Turkmenistan. Financial warfare indeed escalating. China believes U.S. tax reform weakens Washington’s ability to repay debt. Nobody in their right mind would buy the stock market on such news, nevertheless, the Dow, Nasdaq, & S&P all continue to power higher and ignore risk. Even CNBC’s Jim Cramer warned that a trade war with China is the number one risk to the stock market rally, and also the number two and number three risk. According to the WSJ, this variable could emerge as a 2018 spoiler. If it happens, ’Everybody has to cut numbers,’ Cramer added.

China’s power play against the dollar makes sense on a number of levels. This is something that’s been in the works for years, but China’s war against cryptocurrency only makes sense if bitcoin is in fact tied to the United States.

In response to Chinese tactics of de-dollarization, President Trump has initiated a trade war with up to 50% tariffs on imported solar cells and washing machines. China commented that these ‘U.S. tariffs will hurt healthy development of its industries and worsen the global trade environment’. South Korea, who is also affected, issued the following statement, ‘The government will actively respond to the spread of protectionist measures to defend national interests.’ This trade war variable is capable of growing from something small into something that could consume the global economy. It was Herbert Hoover’s trade war in combination with rising interest rates from the Federal Reserve that jumpstarted the Great Depression of the 1930’s. As of today January 23rd, we’re now in the early stages of a similar environment. As President Trump begins his second year it appears he is making another run at an agenda of ‘America First’ protectionism. The stock market has barely paid attention knowing that Gary Cohn and Steve Mnuchin are staunchly opposed. Nevertheless, financial warfare between China and the USA is heating up.

So far the market negates risk in this low volatility environment. We're watching for signals that the market inevitably goes through a bearish period but we just don't have it yet. To the contrary, the market continues to demonstrate that it doesn't give a hoot about such things as Gov shutdown, trade wars, de-dollarization etc.

Nonetheless, every bull market has pullback cycles and we are watching closely for that trade setup to transpire. Until then, the benefit of the doubt continues to go to the buyers of this market. Don't make the mistake of being in the bearish camp. It's a bull market party. Put on your bull hat

Comments